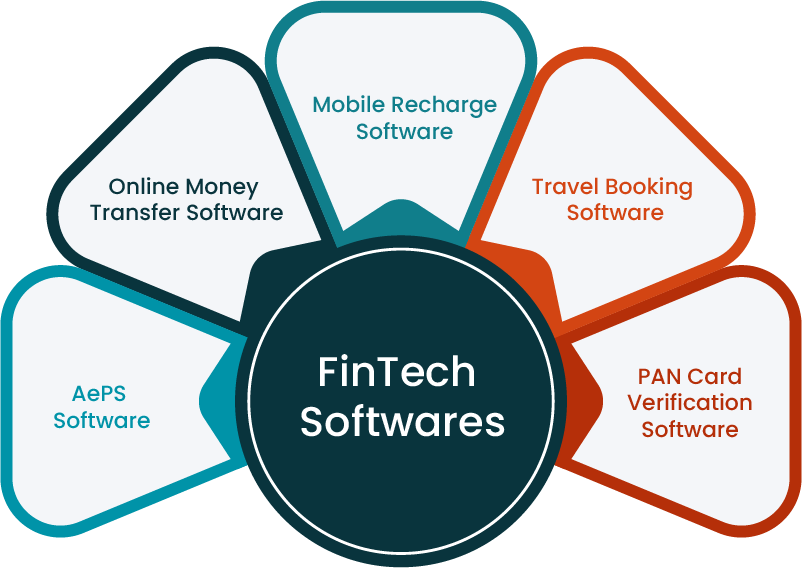

Our range of FinTech software converts intricate financial transactions into digital payment solutions. The aim of our FinTech software is to enable and support many ambitious entrepreneurs looking to thrive in the FinTech sector.

Our comprehensive FinTech software suite offers a turnkey business startup concept for those eager to launch what we term an Admin business. Embark on your exciting path to becoming a prominent figure in FinTech today by exploring our extensive array of APIs.

Our B2B FinTech software prioritizes catering to administrators, yet its advantages extend far beyond this demographic. As a FinTech software development firm, our software suite is designed with a vision to benefit society at large. Here's how we deliver widespread benefits:

The administrators are individuals looking to integrate all six aforementioned services into a unified software solution, all within the realm of FinTech. Our FinTech software suite plays a pivotal role in fostering successful FinTech enterprises. Moreover, through a straightforward commission-based revenue model, administrators can generate multiple income streams.

In this business model, intermediaries are represented by merchants and retailers who acquire login credentials from the administrator and integrate one, two, or potentially more services into their establishments. These retailers possess sufficient technological proficiency to facilitate online transactions on behalf of customers, thereby driving increased foot traffic to their stores.

At the same time, residents in rural, underserved, and remote areas, as well as those with limited computer skills, also experience significant advantages. They are no longer required to endure lengthy queues or travel extensive distances from their homes to handle tasks such as paying utility bills, recharging mobile phones, or sending money to family members.

This sets SevenUnique apart from other FinTech software development companies. While many focus solely on creating applications that generate rapid revenue for business owners, we prioritize creating value and enriching society. Our mission is to make technology and FinTech services accessible to everyone, thereby fostering widespread benefit.

Explore the distinctive qualities of our FinTech software that set it apart from other robust solutions offered by FinTech software development companies. Discover the innovative features that make our FinTech software stand out.

Our comprehensive FinTech software suite is tailored for B2B applications, empowering ambitious FinTech entrepreneurs to realize their aspirations. Through a sophisticated B2B FinTech admin panel, users gain access to a diverse range of FinTech services, facilitating business growth and innovation in the sector.

As the sole FinTech software development company offering a comprehensive suite encompassing six distinct APIs—namely AePS, PAN Verification, Mobile Recharge, BBPS, Online Travel Booking, and Banking APIs—we uniquely unlock diverse business opportunities and revenue streams for administrators. This consolidated approach enables seamless integration and robust functionality, fostering enhanced business potential and profitability.

Our FinTech software suite offers complete customization, allowing service providers the flexibility to select and integrate two or more APIs according to their business needs. For instance, as an administrator, you can opt to offer specific services such as AePS, PAN Verification, and Online Money Transfer while excluding others. This flexibility extends to choosing the number and variety of services you wish to provide, ensuring tailored solutions that meet your operational requirements effectively.

Through our clear and analytics-driven B2B FinTech admin panel, administrators maintain full visibility over all transactions. They can effortlessly monitor transaction volumes and track revenue generated from commissions. Our software suite supports scalable business objectives and revenue targets by delivering comprehensive data analytics and detailed reporting capabilities..

Our software suite boasts an intuitive and user-friendly UI/UX design. Our FinTech development team excels in both FinTech application development and software engineering, positioning us as a versatile FinTech app development company as well. We've seamlessly integrated our skills and expertise into this software suite, ensuring a streamlined user experience akin to using a mobile application—simple, engaging, and effortlessly navigable.

In our all-encompassing solution, we prioritize cybersecurity to safeguard sensitive information such as financial transactions, Aadhaar details, and banking information of our customers. Given the constant threat posed by cybercriminals using deceptive tactics, our software is meticulously designed to be impervious to malware and fortified with robust encryption protocols. Our stringent data security measures strictly adhere to regulatory standards, ensuring utmost protection for our users' data.

Our B2B Admin Portal offers full transparency and interactivity. Administrators have comprehensive access to transaction records, data analytics, and revenue reports. Additionally, they receive real-time updates on payment statuses for each transaction. This commitment to transparency within our admin dashboards guarantees high success rates for payments while providing administrators with detailed insights and control over their operations.

Ever considered launching a business offering AePS, PAN Verification, Online Money Transfer, Utility Bill Payment, and Mobile Recharge through one convenient online platform? It might seem like a daunting task, but at SevenUnique, we specialize in turning challenges into opportunities! Our FinTech software seamlessly integrates these diverse transactions into a unified solution. As a business owner, you can capitalize on lucrative commissions. Here’s a brief overview of our advanced B2B FinTech Software.

As a leading FinTech software development firm, we are at the forefront of AePS software innovation. While AePS software represents a significant component of our suite, it is just one facet of our comprehensive offerings. Entrepreneurs aspiring to enter the FinTech industry and provide Aadhaar-enabled banking services across India can leverage our specialized AePS B2B software for their ventures.

AePS, short for Aadhaar Enabled Payment System, is a banking service that facilitates cash withdrawals using Aadhaar cards. This initiative, endorsed by the Indian government, aims to extend banking services to remote and underserved regions. We specialize in developing B2B AePS admin panels for entrepreneurs looking to establish and expand this business model across various levels.

TIn rural, underserved, and semi-urban India, offline mobile recharge services remain crucial as online methods are predominantly familiar only in metro areas. Physical recharge outlets often rely on multiple software solutions and various websites for different broadband recharges. Our FinTech software portal simplifies this process by enabling these outlets to recharge multiple broadband services through a unified platform, streamlining operations and enhancing efficiency.

Our Mobile Recharge Software empowers service providers to recharge various broadband brands using a unified portal. We offer a B2B Multi Recharge Admin Panel, enabling administrators to deploy versatile multi-recharge software across multiple tiers or levels of operation.

As an administrator of our FinTech software, you have the opportunity to onboard small retailers and merchants to offer essential banking services such as cash withdrawals, domestic money transfers, balance inquiries, and more in their local communities. Through our extensive B2B Money Transfer Software portal, you gain full oversight of every transaction. Multiple retailers, agents, and merchants operate under your brand, expanding your service reach and impact.

Our Money Transfer Business Software empowers aspiring administrators to grant access to various merchants and retailers, positioning them as the central authority and overseeing entity. Through this role, administrators ensure that every partner agent fulfills their responsibilities equitably. This capability facilitates domestic money transfers for individuals who may lack proficiency in online banking, thereby enhancing financial inclusivity and accessibility.

Paying utility bills such as electricity, water, and gas online has become convenient, yet not everyone can fully utilize these services. As a business visionary, you can seize this opportunity. Our Utility Bill Payment Software empowers administrators to establish a network of agents offering seamless utility bill payment services. This setup allows administrators to generate commissions from multiple streams, capitalizing on the growing demand for accessible and efficient bill payment solutions.

The Baharat Bill Payment System (BBPS) Software streamlines multiple bill payment services into a unified platform. Whether it's electricity, water, gas pipelines, or other domestic utilities, users can conveniently settle bills across various channels through a single portal, eliminating the need to navigate multiple websites. This integrated approach simplifies the payment process and enhances user convenience, making bill payments more accessible and efficient.

Through our FinTech Software Suite, administrators have the capability to establish numerous service providers offering online booking services for tours, travel, and hotels. As the central authority, administrators can grant access to various agents within their network. Our Travel Booking Software admin panel provides comprehensive transparency and detailed transaction reports to empower administrators with valuable insights into every transaction. This setup ensures efficient management and oversight of booking services, enhancing operational control and customer satisfaction.

Our Travel Agency Software integrates APIs for both hotel and ticket bookings into a unified platform. This enables administrators to empower their affiliates to offer seamless online booking services for tickets and hotels through a single portal.

You have the opportunity to become an authorized administrator with our Pancard Verification Software, facilitating PAN card verification. The PAN card plays a pivotal role in all financial transactions, whether conducted online or offline. As part of our comprehensive software suite, we have integrated the PAN Verification API, ensuring seamless verification processes for enhanced financial security and compliance.

To begin utilizing the PAN Verification API within our FinTech Software suite, administrators are required to first register on the official NSDL website. Subsequently, administrators can extend the PAN Verification service to subordinate agents, merchants, and retailers as part of their business model. While the API is integrated into our software suite, activation for administrative use is contingent upon completing the registration process with NSDL. This approach ensures compliance and enables seamless implementation of PAN Verification services across various operational levels.

SevenUnique stands out in the FinTech Software Development industry as a trusted name you can rely on. We specialize in offering highly customizable B2B FinTech software tools, FinTech applications, and FinTech web apps. Here are several compelling reasons to choose us: